California Tax Brackets 2025 Married Filing Separately

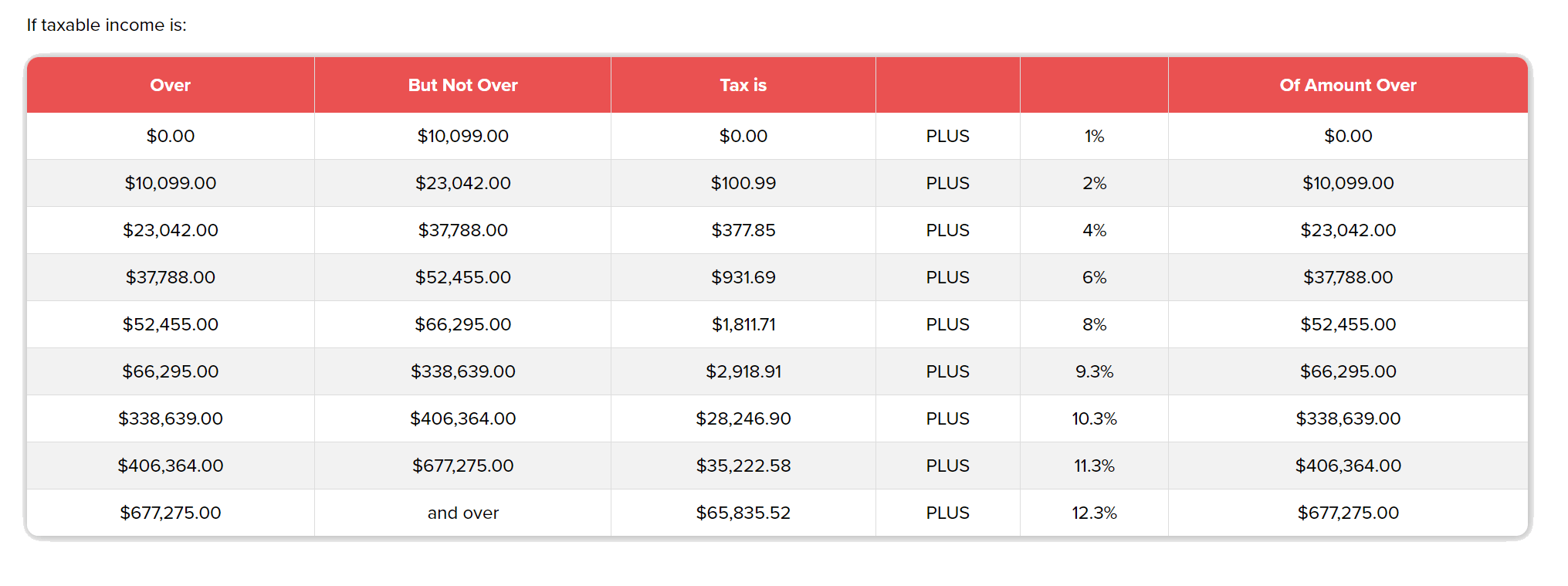

California Tax Brackets 2025 Married Filing Separately. If you’re married/registered domestic partner (rdp), you may choose to file separately. California’s income tax rates are progressive, meaning the more you earn, the higher your tax rate.

2025 Tax Brackets Married Filing Separately Married Ayla Harper, In 2025, the excess taxable income above which the 28% tax rate applies will likely be $119,550 for married taxpayers filing separate returns and $239,100 for all other non.

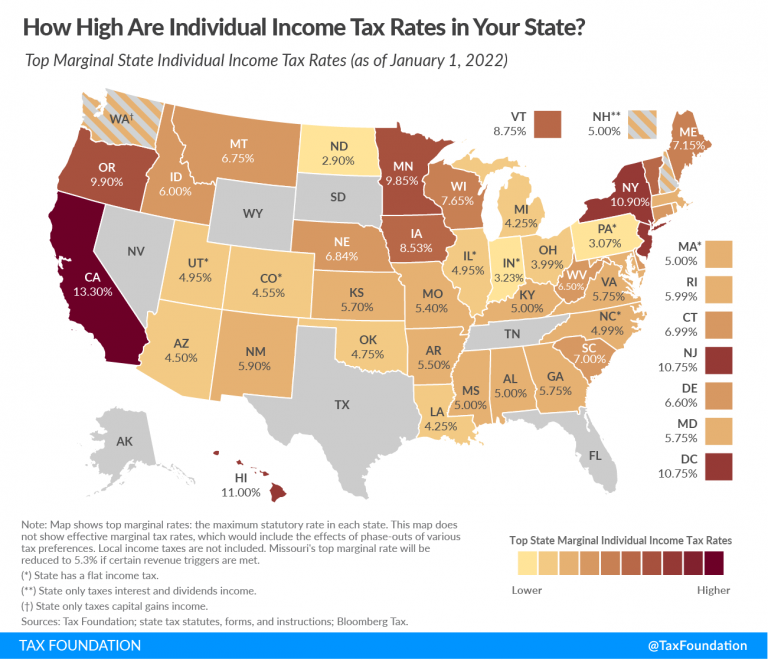

2025 Tax Brackets Married Filing Separately Married Ayla Harper, California's 2025 income tax ranges from 1% to 13.3%.

California Tax Brackets 2025 2025 Married Filing Separately Kacie Letisha, The california tax estimator lets you calculate your state taxes for the tax year.

California State Tax Brackets 2025 Single Estefana Hope, California's 2025 income tax ranges from 1% to 13.3%.

Irs Tax Bracket Married Filing Jointly 2025 Olivia Amal, Each spouse or partner will prepare a separate tax return and report their individual income and.

Us Tax Brackets 2025 Married Filing Jointly 2025 Rea Harlene, Each spouse or partner will prepare a separate tax return and report their individual income and.

2025 Married Filing Separately Tax Brackets Merle Kyrstin, Single or married filing separately:

Tax Brackets For Married Filing Jointly 2025 Lorrai Nekaiser, In other words, higher income is taxed at higher.